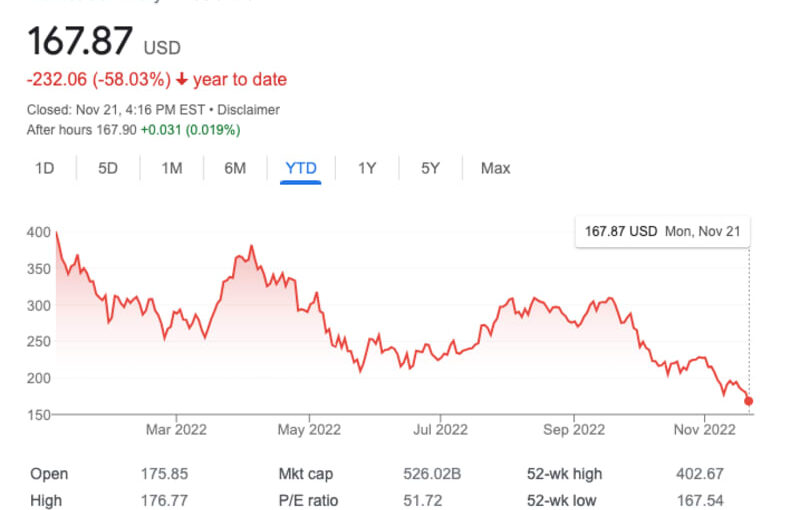

The thrashing in Tesla shares is increasing as a recall and also indicators of China‘s go back to Covid Zero visuals contributes to a list of investor concerns, with Chief Executive Officer Elon Musk focused on reversing Twitter Inc.

The electric-vehicle maker’s supply dropped as much as 6.5% to $168.52 in New York on Monday, on pace to shut at the lowest considering that November 2020. Investor stress and anxiety was higher after a city near Beijing returned to lockdowns, placing both manufacturing as well as sales at risk. Tesla additionally initiated a recall of more than 300,000 vehicles as a result of defective taillights.

Tesla’s shares have actually lost virtually fifty percent of their worth in much less than 2 months as supply-chain snarls install, raw-material costs rise and possible buyers feel the press of stubborn rising cost of living as well as climbing rates of interest.

On top of that, Musk has been busied by his freshly obtained social-media system, leaving some capitalists to fret that Tesla’s approach may fall to the wayside.

“Weakening macro data in China is leading to problems on Tesla, who has actually currently reduced rate when to boost need as well as has a hefty export result in the initial fifty percent of fourth quarter,” Cowen expert Jeffrey Osborne composed in a Friday note.

The expert added that bush funds seem to be moving to an unfavorable prejudice on the stock because of take the chance of there’s been “a loss of focus” on Tesla because Musk got Twitter.

The company’s current supply decrease marks a significant retracement of a number of landmarks reached during its meteoric rise in 2020 and 2021.

Tesla was supplanted as the fifth-most important firm on the S&P 500 Index by old-economy stalwart Berkshire Hathaway Inc. previously this month.

The cars and truck firm, which shed its trillion-dollar-valuation status in late April, only needs its shares to roll an additional 6.5% from present degrees for the appraisal to drop listed below $500 billion.

For GREAT deals on a new or used Chevrolet, Buick, and GMC check out Reynolds Chevrolet Buick GMC TODAY!